- Ad Sales Genius Knowledge Base

- Subscription Genius

- E-Commerce Guide

SG - Setting Up Sales Tax

You may need to add sales tax to your publication and/or products, or to various countries. While some include sales tax in their overall bundle price, many like to separate the tax out for accounting purposes. To set up your sales tax settings, follow these steps:

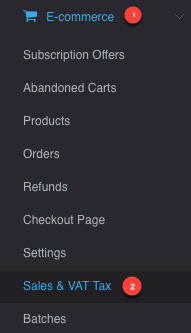

- Choose E-Commerce from the left-hand side, and then select Sales & VAT Tax.

- Select either the publication or product you need to collect tax on, the state that needs to be taxed, and whether you want your print or digital edition to be taxed - or both. You will notice that you can also delete any taxable items you create from here as well.

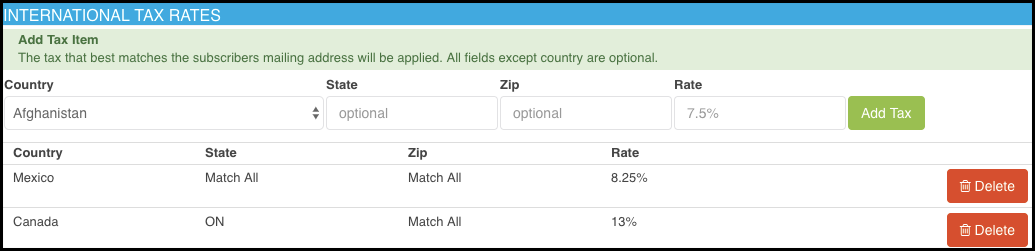

- If you need to set up tax for international countries, you can assign the country and rate at the bottom of the Sales & VAT Tax page.