- Ad Sales Genius Knowledge Base

- Accounting

- Invoices Management

Finance Charges

A Finance Charge is a fee assessed to Past Due Invoices, read on for set up and guides on how to assess Finance Charges

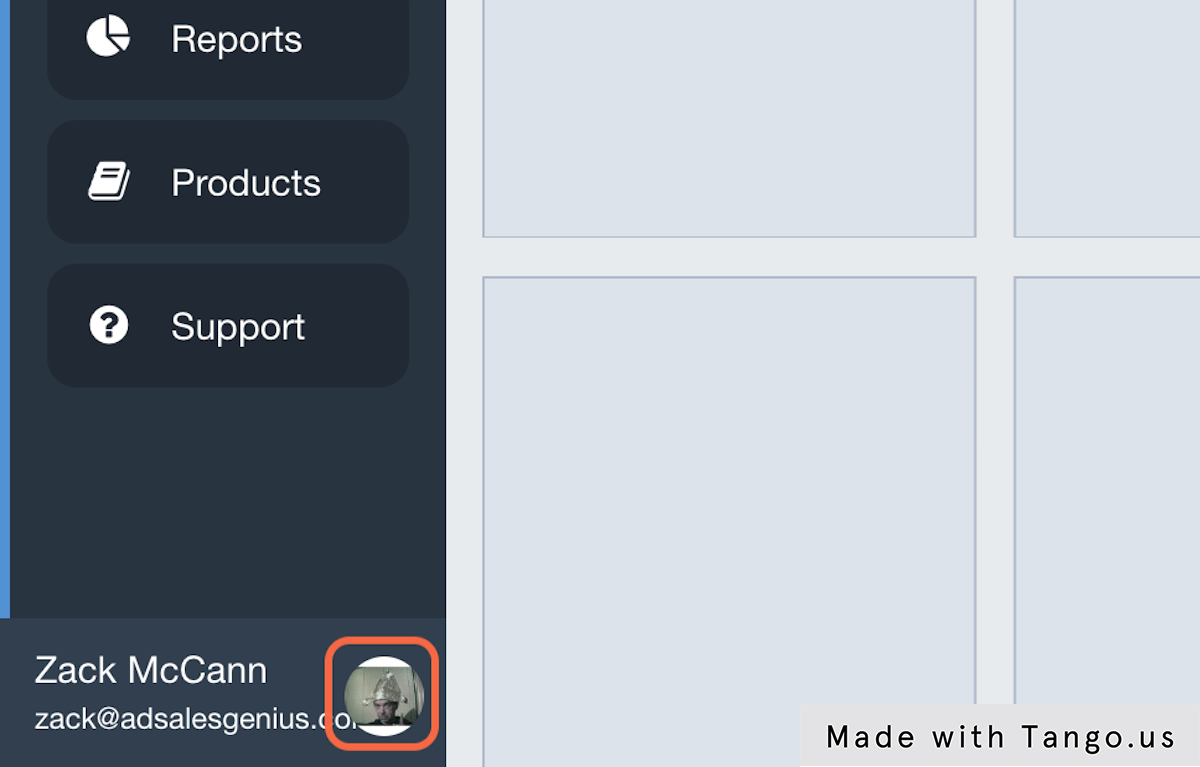

1. Click on your Profile Image

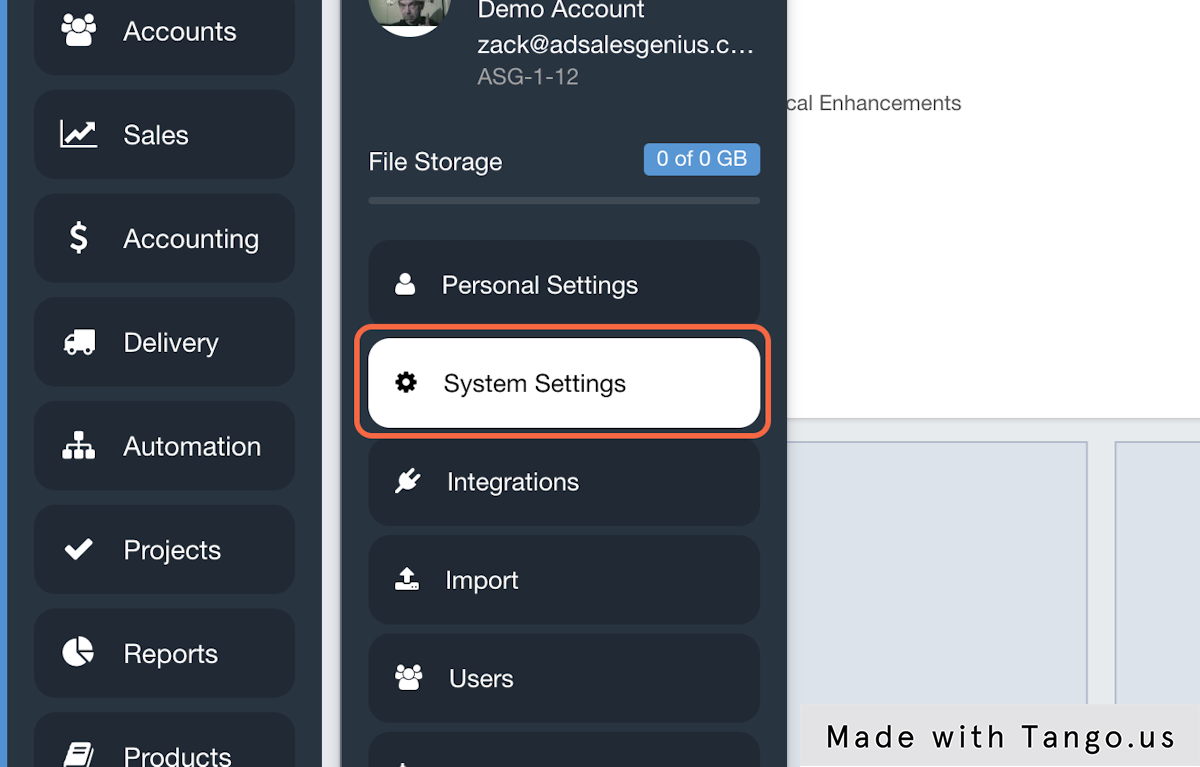

2. Click on System Settings

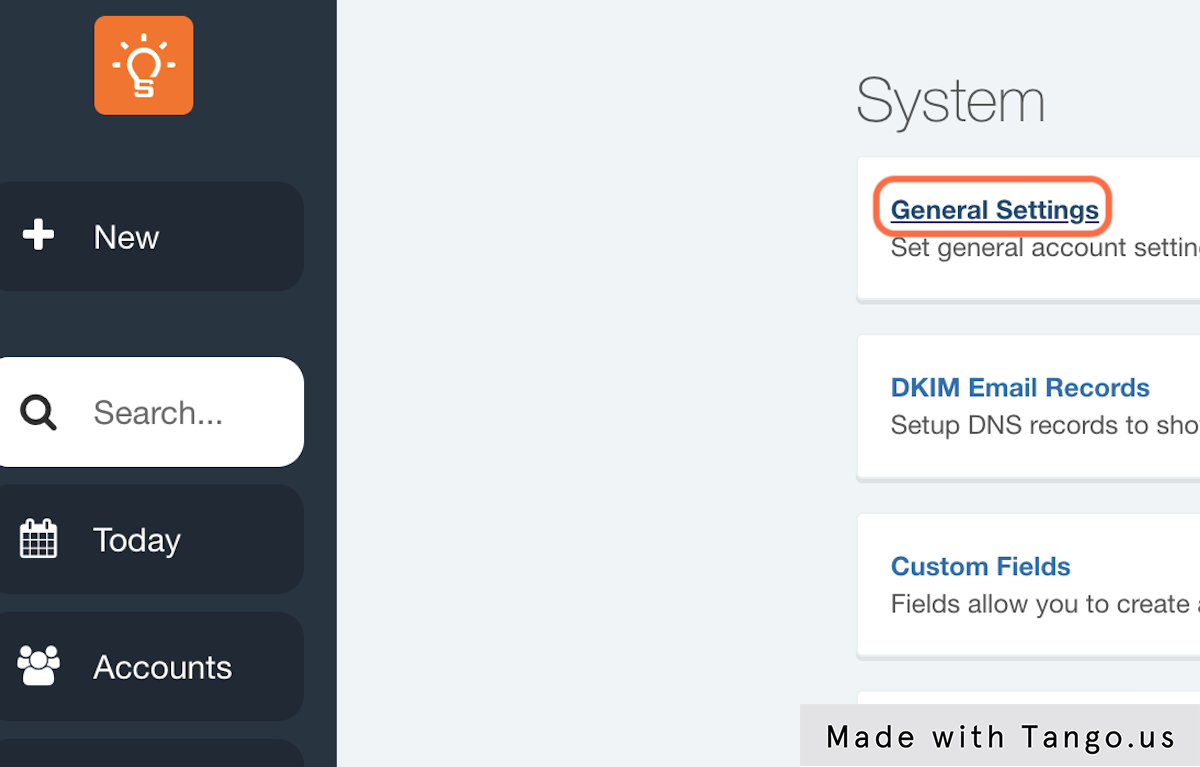

3. Click on General Settings

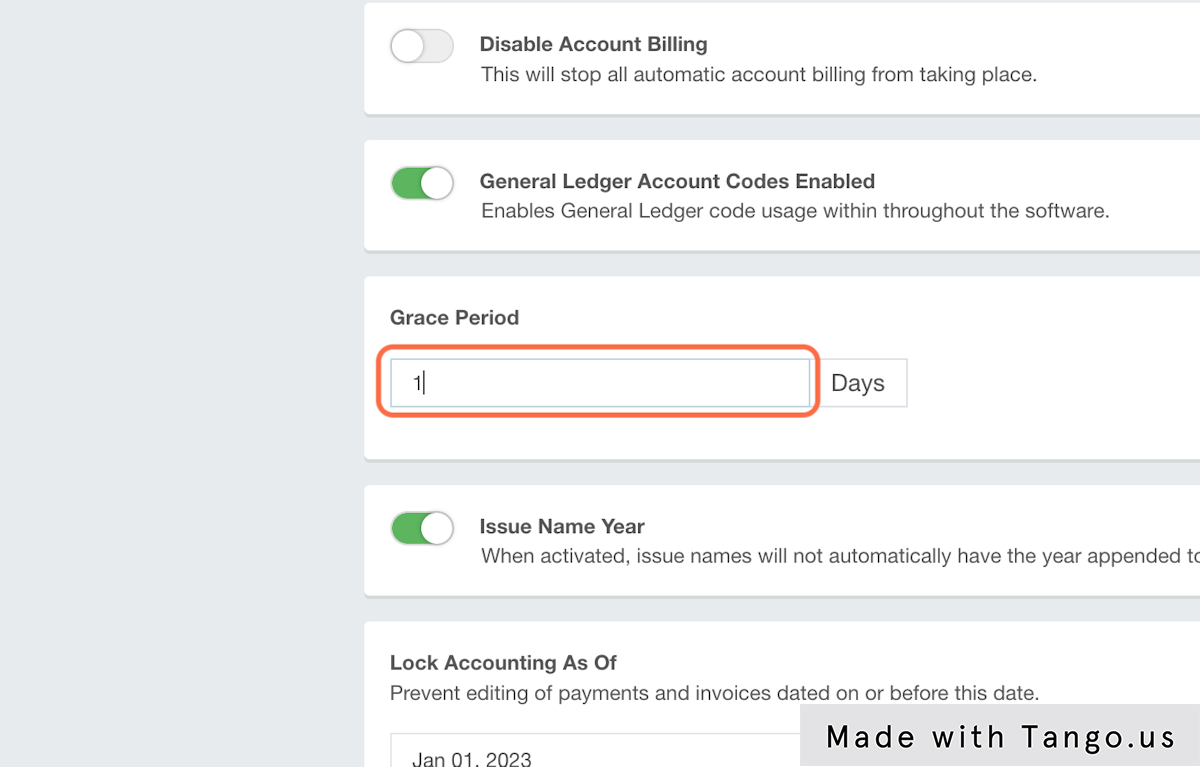

4. Choose a Grace Period

You have the ability to decide if you would like grant a grace period before interest begins being assessed to a Past Due Invoice.

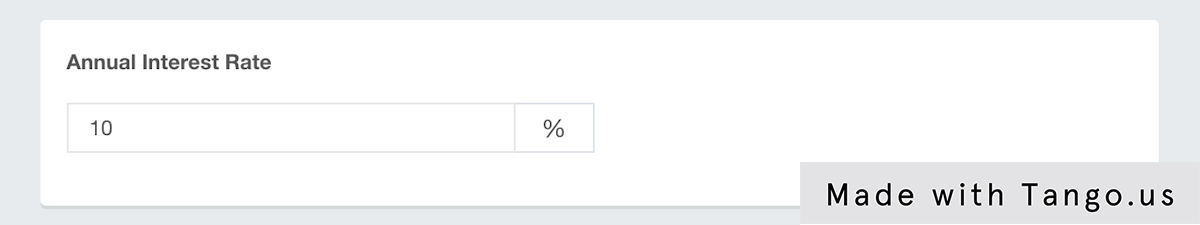

5. Decide Your Interest Rate for Finance Charges

Under the Invoicing section of General Settings, you'll find Annual Interest Rate, this will determine the amount assessed on your Finance Charges.

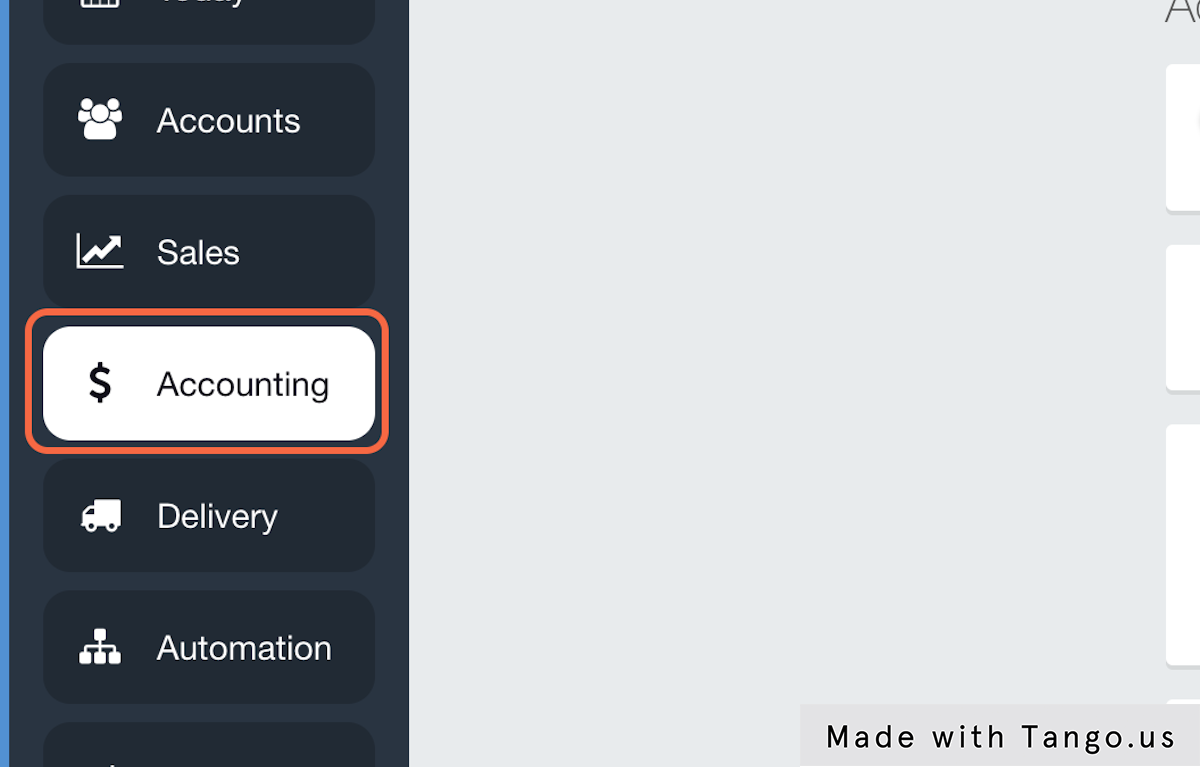

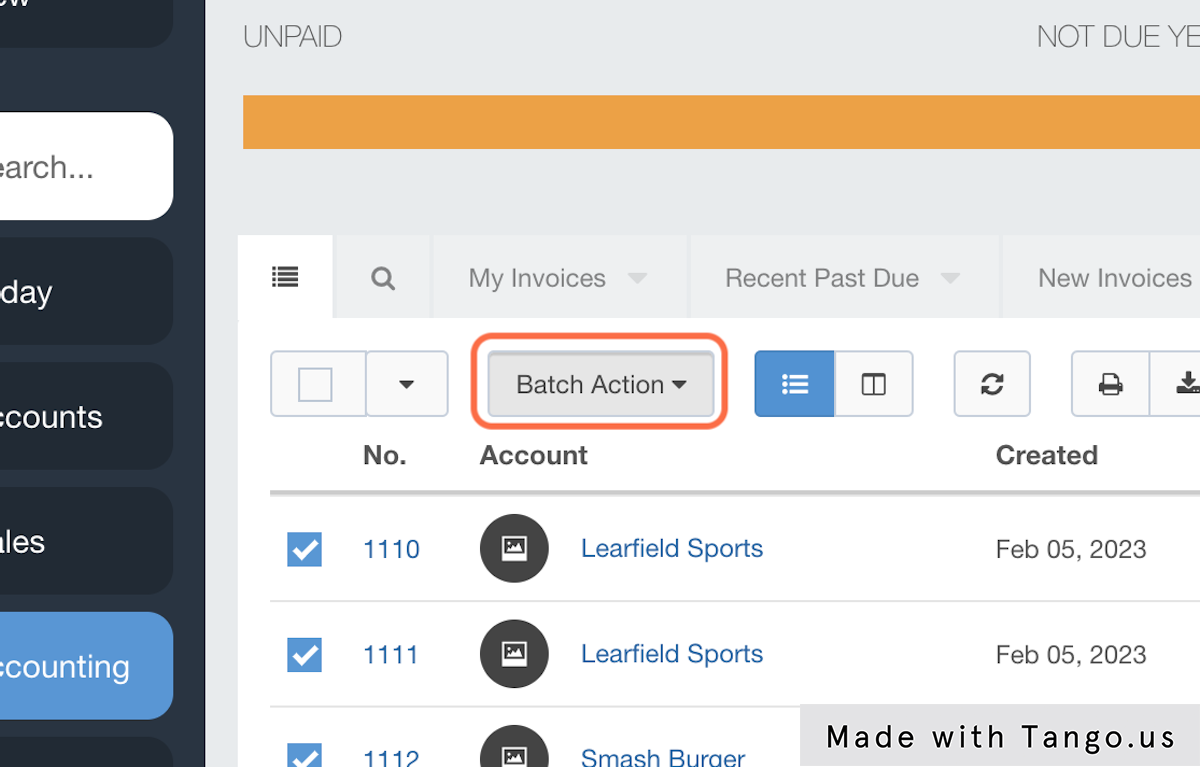

6. Now, let's assess a finance charge. First, click on Accounting

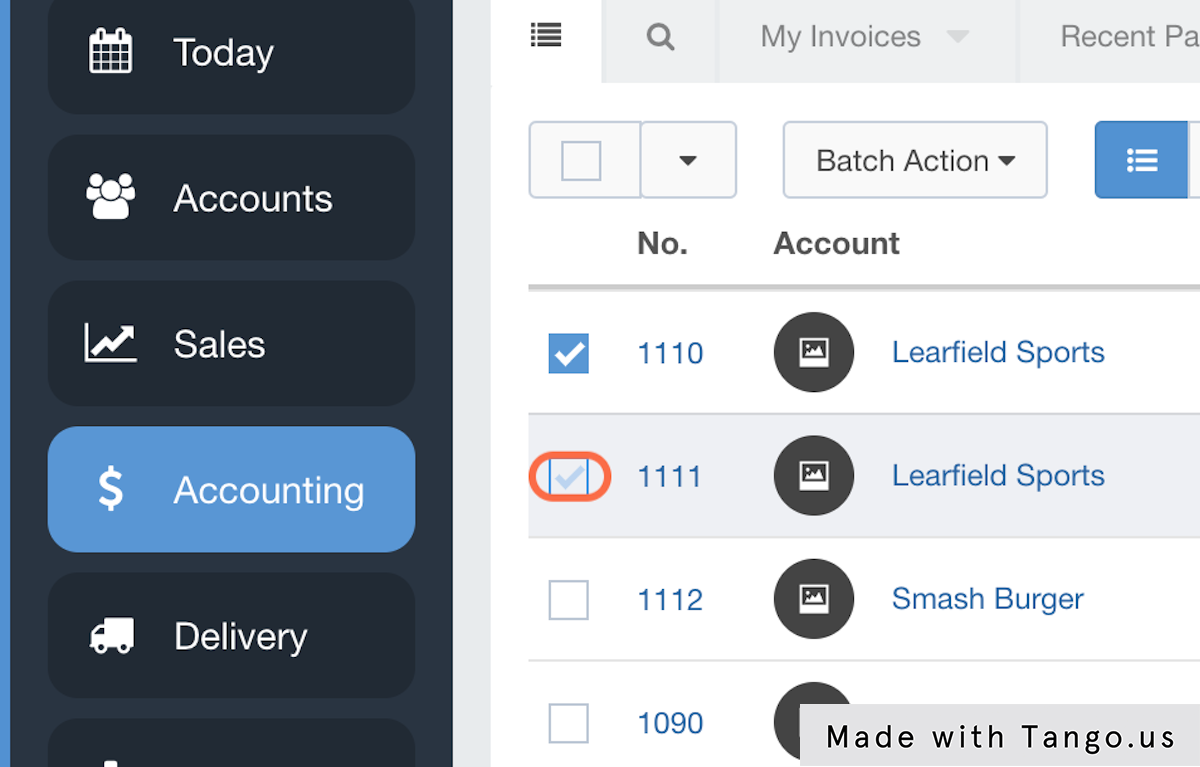

7. Check the Boxes for the Invoices you would like to assess the charge to:

8. Click on Batch Action

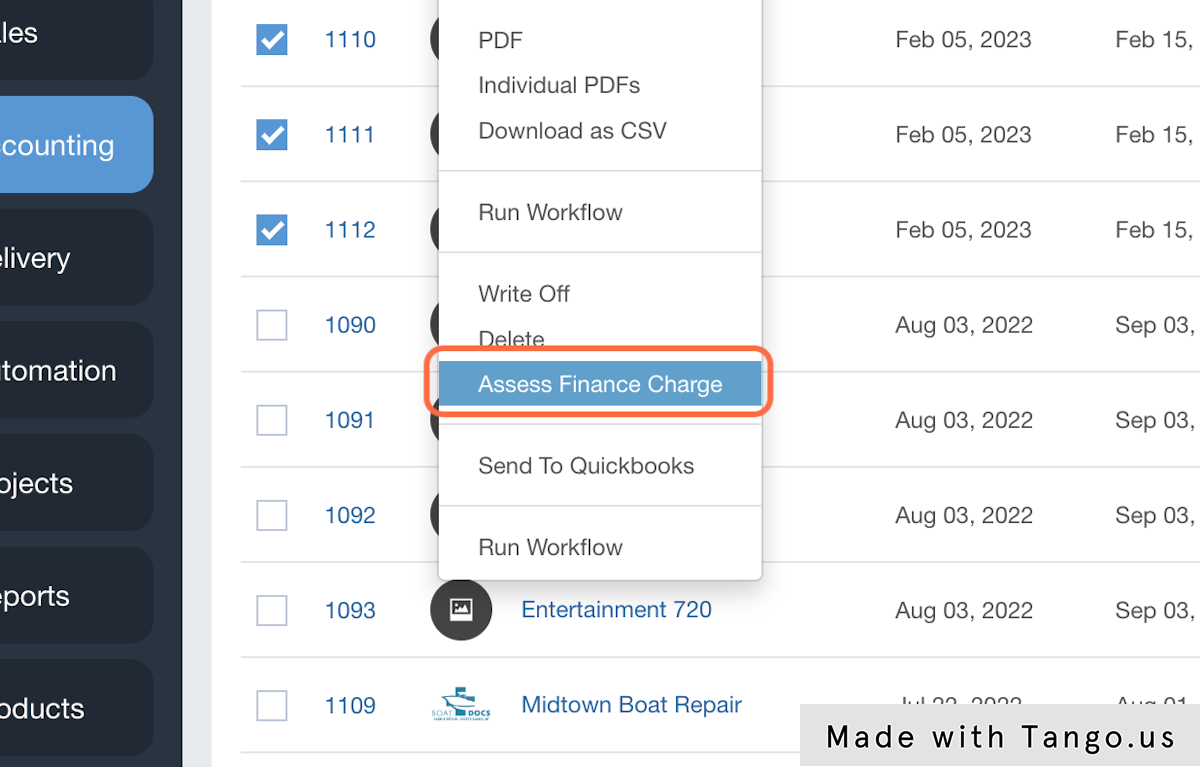

9. Click on Assess Finance Charge

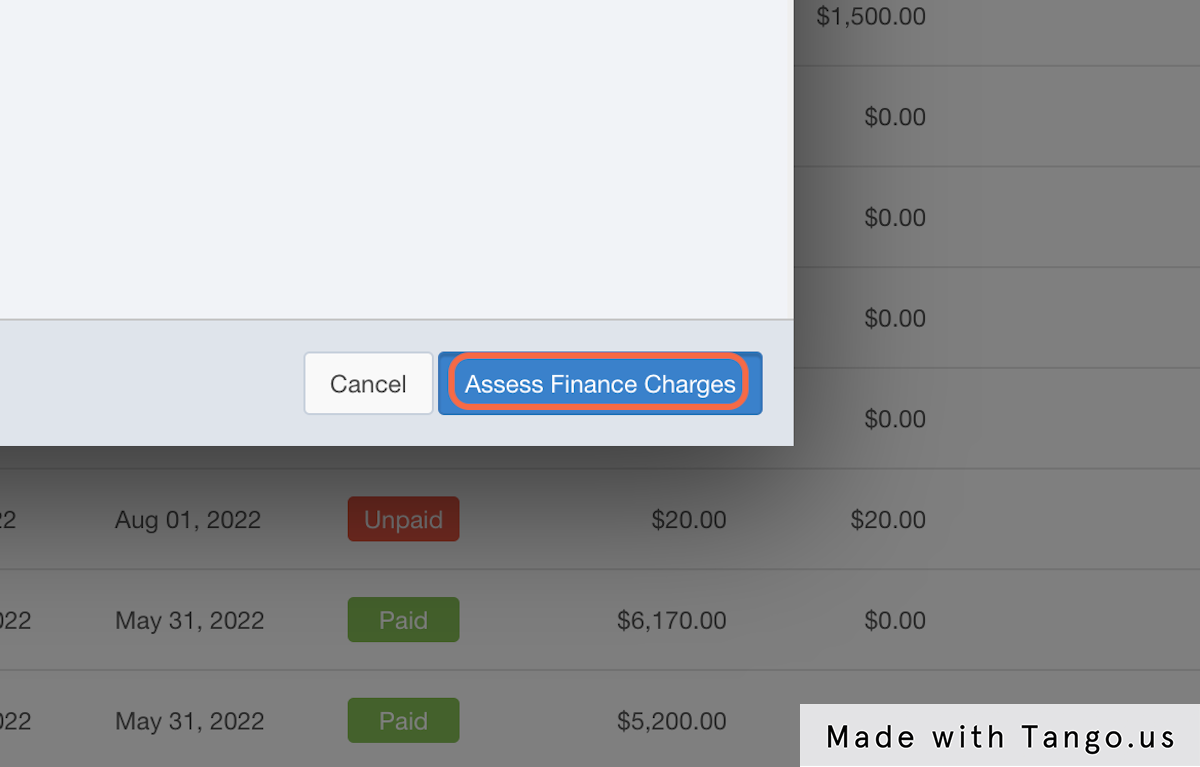

10. Click on Assess Finance Charges

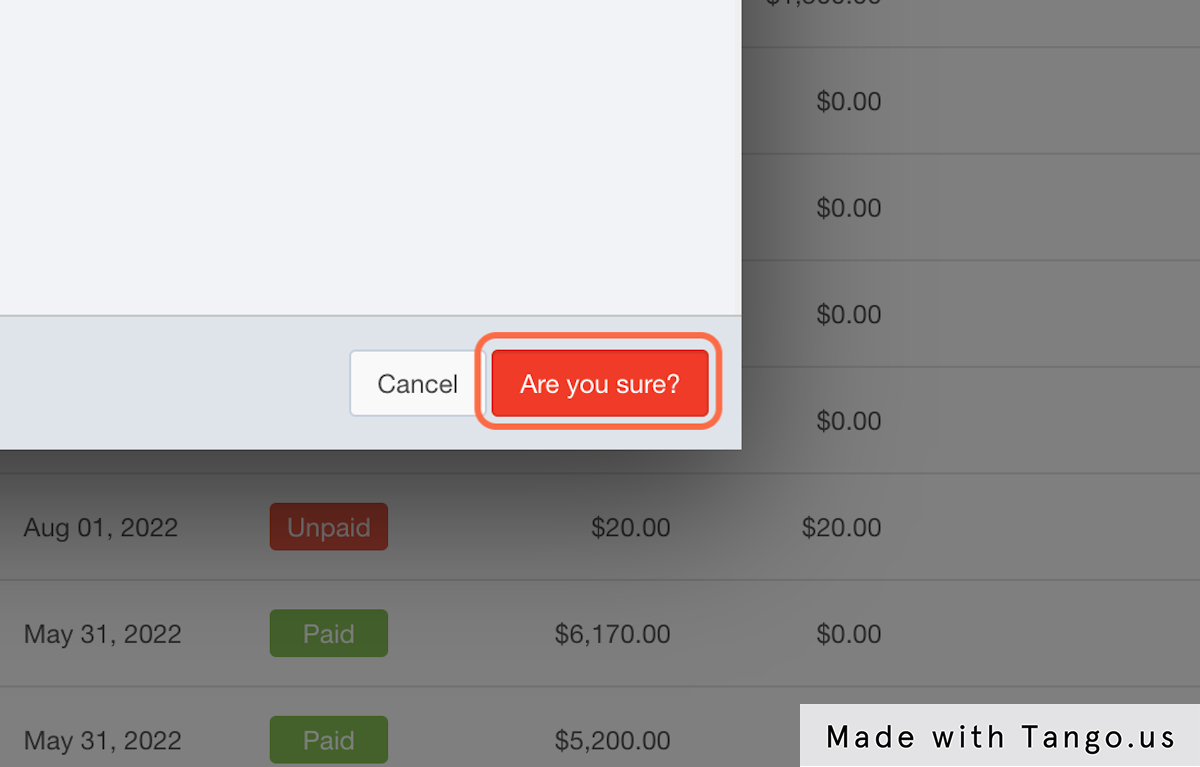

11. Click on Are you sure?

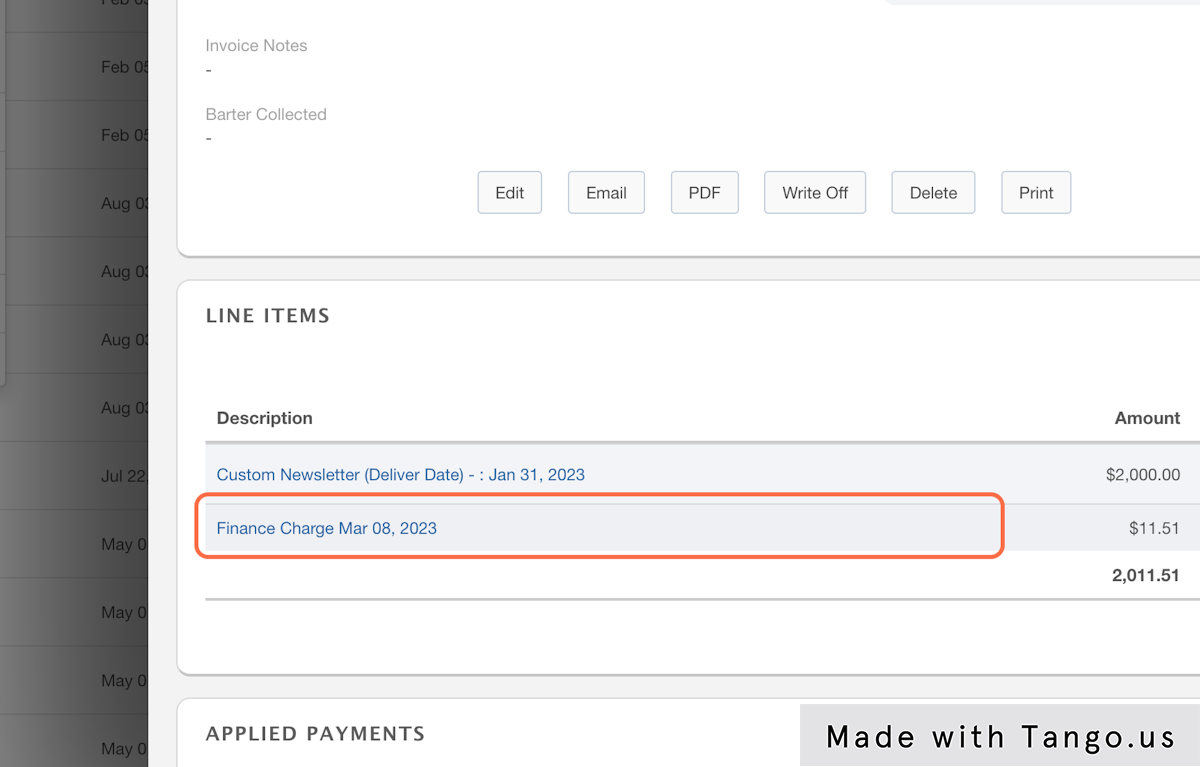

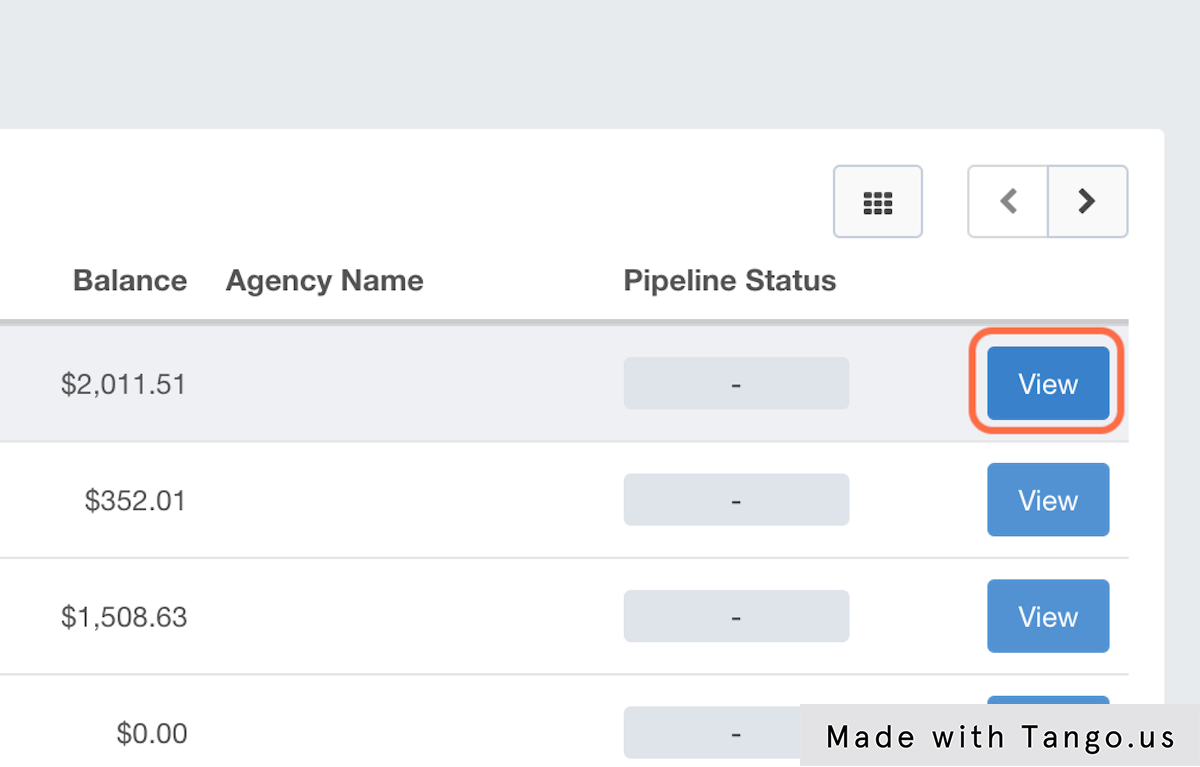

12. To see your newly assessed charge, click on View

13. Click on Finance Charge Mar 08, 2023